3 Key Steps to Ingrain Wealth-Building Habits in Your Teenager

By Eltoro | Harry Colt

From our guest Shailesh Kumar – Empowering Teens to Build Financial Independence, Achieve Long-Term Security, and Develop a Mindset That Lasts a Lifetime.

| HARRY COLT AND SHAILESH KUMAR, MBA DEC 5 |

Hi fellow investors and welcome back for a guest newsletter. [Full Disclaimer]

First, a little about me:

Hi, I’m Shailesh Kumar, and I’m here to help you craft your ultimate edge in long-term investing. Through my Substack newsletter, Astute Investor’s Calculus, I dive deep into the world of small-cap value stocks, the top-performing asset class, and show you how to build a portfolio that’s designed to deliver exceptional results.

Here’s what makes my approach different:

- I focus on high-performing small-cap value stocks—the hidden gems of the market that have historically outperformed other asset classes.

- I use the Kelly Criterion to optimize your portfolio allocations, ensuring you’re maximizing returns while managing risk.

- I take a mathematically balanced approach to reduce volatility, so your portfolio stays steady even when the market doesn’t.

If you’re tired of guesswork and want a calculated, proven strategy to grow your wealth with confidence, Astute Investor’s Calculus is for you. I deliver actionable insights and fresh ideas straight to your inbox, helping you make smarter investment decisions and build a portfolio that stands the test of time.

Ready to take your investing to the next level? Subscribe to Astute Investor’s Calculus today and start building the financial future you deserve.

Subscribe to Astute Investor’s Calculus

Please note: I am not a financial advisor and this is not financial advice. You can lose money investing in something you do not understand so please do your own due diligence.

Let’s get right into it.

A 2022 poll from the National Endowment of Financial Education (NEFE®) found that 80% of the US Adults wish they were offered a semester or year-long course on financial literacy in high school. Among its findings,

- 88% said their state should require a semester- or year-long financial education course for graduation.

- 80% said they wish they were required to take a semester- or year-long financial education course during high school.

- 75% said that spending and budgeting is the most important financial education topic to teach for personal finance education, followed by managing credit (55%), saving (49%) and earning income (47 %).

These numbers paint a clear picture: financial education is not just a “nice to have”; it’s a critical skill set that most adults recognize they lacked in their formative years. Yet, while many schools are beginning to adopt financial literacy programs, there’s a key distinction we must help teens grasp—one that goes beyond budgeting and saving. It’s the difference between chasing “riches” and building true “wealth.”

Riches are often defined by flashy displays of material success—expensive cars, designer clothes, and the instant gratification of living in the moment.

Wealth, on the other hand, is about long-term financial stability and freedom. It’s not just about having money; it’s about building a secure foundation that grows over time, enabling you to weather challenges, pursue opportunities, and create a meaningful legacy.

In today’s social media-driven world, where the pursuit of riches and fame is glorified, it’s more important than ever to guide teens toward the principles of wealth-building. This shift in mindset can empower them to make smarter financial decisions, prioritize sustainable growth over fleeting gains, and achieve a future of true independence

Your teenager is busy exploring the world and building their identity. What do they see in the world around them in today’s digital age? There is an abundance of glamorous portrayals of “success” on social media platforms and in pop culture. These often equate success with riches and fame.

What is it about these ideals that capture teens’ attention so strongly?

The Allure of Instant Gratification

Social media platforms like Instagram, TikTok, and YouTube showcase influencers and celebrities flaunting luxurious lifestyles—designer clothes, exotic vacations, luxury cars—all of which seem temptingly within reach.

These images promote the idea that wealth is about spending and that success comes quickly and effortlessly. There is even a bestselling book that promotes the idea that riches can be had for working just 4 hours a week. For teens, who are naturally drawn to immediate rewards, this can create an unrealistic and superficial view of financial success.

The Appeal of Fame as a Shortcut to Riches

Many teens also see fame as the gateway to riches. Viral trends, reality TV, and influencer culture highlight individuals who achieve sudden notoriety and financial gain seemingly overnight.

These stories rarely emphasize the hard work, discipline, or long-term planning that often underpin genuine success, leaving teens with the impression that fame is the ultimate goal.

The Risks of a Riches-First Mentality

The trouble with chasing riches and fame is that they don’t last. Lavish spending without a strong financial foundation often leads to debt, stress, and instability. Take lottery winners or professional athletes, for example—many end up bankrupt because they don’t have the knowledge or habits needed to manage their money wisely. Without a plan to grow and sustain wealth, even millions of dollars can vanish in no time.

Shifting the Focus to Wealth

To change this way of thinking, we need to help teens look past the shiny appeal of riches. They need to see that real wealth isn’t about what you can buy right now—it’s about the freedom and security you can build for the future. This kind of mindset shift doesn’t come from lectures alone. It takes relatable examples, practical tools, and regular reminders of the values that lead to lasting financial independence.

For many teens, the idea of wealth can feel vague or out of reach, especially when so much of their attention is on instant rewards and material success. To help them truly understand what wealth means, we need to break it down and give them practical steps to start building it.

Redefining Wealth: Financial Freedom vs. Flashy Purchases

Wealth isn’t about owning the latest gadgets, wearing designer clothes, or driving flashy cars. It’s about building a solid financial foundation that gives you stability and freedom.

Wealth means having the ability to make life choices without being held back by money worries. Teens need to understand that real wealth is about the opportunities it opens—whether that’s going to college, starting a business, or taking time to explore their passions—without the stress of living paycheck to paycheck.

Personally, I have found that once my teen started his first part-time job in high school, his attitude toward money changed overnight. He became aware of the fact that money is earned and it needs to be preserved and grown. His first bank account was the Fidelity Youth Brokerage account, which gave him all the banking functions and also gave him tools to invest and grow his wealth.

Core Financial Literacy Principles Teens Need

To build wealth, teens must first understand the basics of personal finance. Here are some foundational principles:

- Budgeting: Teach teens to track their income and expenses, even if it’s just allowance or part-time job earnings. This builds awareness of spending habits.

- Saving: Emphasize the importance of setting aside money regularly, even in small amounts. Introduce the concept of an emergency fund and why it’s a crucial safety net. Something like a Fidelity Youth Account (and also many other bank accounts) has a concept of a basket or envelope where you can save money for specific goals, such as college, a new bike, etc.

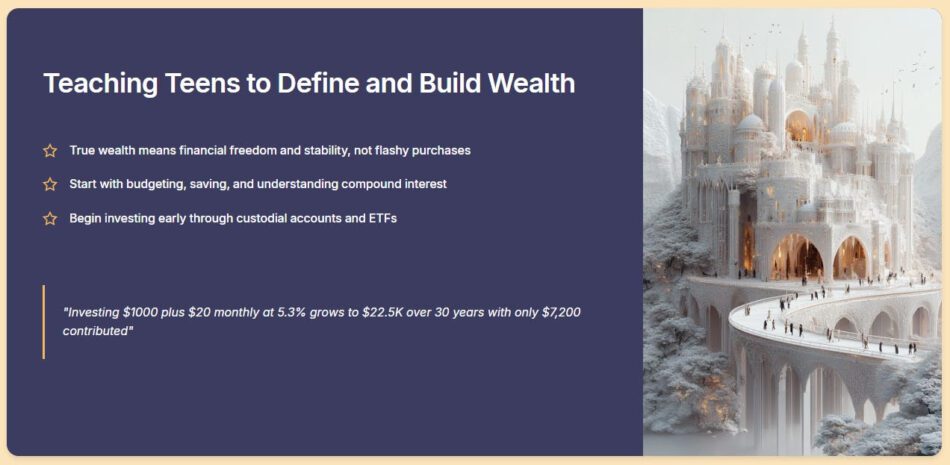

- Compound Interest: Help teens grasp the power of compound interest by showing how even modest investments can grow significantly over time.

Source: helpfulcalculators.com

The above chart shows the growth of $1000 over a period of 30 years when compounded at the rate of 5.3% per year. It assumes that your teen adds only $20 per month after the initial investment. As you can see, at the end of 30 years, this investment is worth almost $22.5K with only $7,200 as the teen’s contribution.

And this assumes investing in a high-yield savings account or very safe treasuries. The returns can be much higher if your teen invests in the stock market.

Breaking Down Investing for Teens

Investing can feel intimidating at first, but breaking it into simple steps can make it approachable for your teen:

- Start Early: Highlight the importance of time in growing wealth. For example, explain how starting at age 16 versus 26 can make a massive difference in returns due to compound interest. You can go to the site Helpful Calculators to create different scenarios and see how the ending wealth changes.

- Custodial Accounts: Guide parents and teens to set up custodial brokerage accounts. These allow teens to learn investing basics under parental supervision while building real-world experience. I mentioned the Fidelity Youth Account. This account lets your teen manage their money and investments themselves but you have supervisory access to the accounts. You can also add money to their accounts, for example, an allowance or reward for doing chores, etc. Other brokerages may have similar youth accounts for teens.

- Understand Risk and Diversification: Teach teens that risk is a natural part of investing and show them how diversification reduces it. Simple analogies, like not “putting all your eggs in one basket,” can help.

Practical Wealth-Building Steps for Teens

Here are a few practical steps to make wealth-building tangible for teens:

- Set Goals: Help them identify short-term (saving for a gaming console), medium-term (college expenses), and long-term (retirement) financial goals. They can do this by setting goals and periodically contributing money to these goals as they earn.

- Start Small: Suggest investing in familiar companies or beginner-friendly ETFs like the Vanguard S&P 500 ETF (VOO) or companies they know, such as Disney or Apple. My son invests in S&P500 and Nasdaq ETFs, SPLG 0.46%↑ and QQQM 1.12%↑ , and 1 stock that he researched and picked himself, AVGO 0.51%↑ .

- Track Progress: Encourage teens to monitor their investments using apps or simple spreadsheets, which makes the process engaging and educational.

Teaching teens to define and build wealth equips them with life skills that go far beyond managing money. It fosters a mindset that values patience, responsibility, and long-term thinking—qualities that will serve them well in every area of life.

In the next section, we’ll explore how to show teens the power of long-term thinking and the incredible results it can deliver.

| Investing Checklist For Teens51.5KB ∙ PDF file |

DOWNLOAD

One of the best lessons we can teach teens about money is the power of long-term thinking. In a world where instant gratification rules, learning to plan for the future and be patient can feel like a superpower. And this mindset doesn’t just help with investing—it can completely change how they tackle life.

The Marshmallow Test: A Lesson in Patience

A famous psychological study, the “marshmallow test,” perfectly illustrates the power of delayed gratification. In the experiment, young children were given a choice: they could eat one marshmallow immediately or wait 15 minutes and get two marshmallows instead. Years later, researchers found that the children who waited tended to have better life outcomes, from higher academic success to improved financial stability.

This simple concept is at the heart of long-term thinking. By resisting the temptation of instant rewards, teens can achieve far greater results—whether it’s growing their wealth or building a fulfilling life.

The Benefits of Patience in Investing

Investing is a great example of how patience truly pays off. When teens put their money into something like index funds or stocks and give it time to grow, they can see the magic of compound interest in action. Here’s a simple way to explain it:

If a teen invests $1,000 at age 16 in an index fund that earns an average annual return of 8%, by the time they’re 56, that $1,000 could grow to more than $24,000—even if they never add another dime.

But if they wait until age 26 to invest that same $1,000, it would only grow to about $11,000 by age 56.

The earlier they start and the longer they let their investments grow, the bigger the payoff. It’s just like waiting for the second marshmallow in the marshmallow test—patience leads to much bigger rewards in the end.

Focusing on the Big Picture

Teens are often drawn to short-term rewards, like buying clothes, gadgets, or spending on entertainment. And while it’s important to enjoy life, helping them see the value of balancing what they want today with what they’ll need tomorrow can make all the difference. Long-term thinking changes how they view their money:

Instead of asking, “What can I buy right now?” they start asking, “How can I make my money grow for the future?”

Instead of chasing quick wins, they learn to focus on steady growth and lasting stability.

Applying Long-Term Thinking Beyond Money

The beauty of long-term thinking is that it doesn’t just apply to finances—it’s a mindset that benefits all areas of life:

- In academics, focusing on consistent study habits can lead to better college or career opportunities.

- In relationships, nurturing trust and communication leads to stronger connections over time.

- In personal growth, setting goals and working toward them steadily brings a sense of accomplishment and purpose.

When teens learn the value of long-term thinking through investing, they also gain a framework for making smarter, more intentional decisions in other parts of their lives.

In the next section, we’ll look at how this mindset, combined with wealth-building habits, equips teens with life skills that extend far beyond managing money.

Helping teens focus on building wealth isn’t just about teaching them how to manage money—it’s about giving them life skills that can shape their future. Financial literacy sets the stage for personal growth, better decision-making, and a sense of independence that will help them thrive in all areas of life.

1. Decision-Making Skills

When teens start evaluating financial decisions—like whether to save or spend, or what to invest in—they’re building critical thinking skills. They learn to weigh risks and rewards, think about long-term results, and make smart, strategic choices. And these decision-making skills don’t just apply to money; they carry over into big life choices, like their education, career path, and relationships.

2. Discipline and Consistency

Building wealth means developing good habits, like saving regularly, sticking to a budget, and avoiding impulse spending. These habits teach teens the value of consistency and discipline—skills they’ll need to succeed in whatever goals they choose to pursue.

3. Patience and Delayed Gratification

Investing is one of the best ways to learn patience. When teens get comfortable with the idea of letting their money grow over time, they start to understand the power of delayed gratification. This mindset helps them see the bigger picture, focus on what really matters, and stay grounded even when life throws short-term challenges their way.

4. Problem-Solving and Resilience

Managing money isn’t always smooth sailing—unexpected expenses pop up, markets dip, and mistakes happen. But facing these challenges helps teens build problem-solving skills and resilience. They learn how to adapt, bounce back, and stay focused on their long-term goals, even when things don’t go as planned.

5. Confidence and Independence

There’s nothing more empowering than knowing you’re in control of your financial future. When teens learn how to manage and grow their money, they build a confidence that goes way beyond their bank accounts. They feel capable of making their own decisions and chasing their dreams without having to rely too much on others.

Teaching Wealth as a Life Skill

When we help teens focus on building wealth, we’re teaching them more than just money management—we’re giving them tools to live with intention and confidence. These skills go beyond finances, helping them make smarter choices about their careers, relationships, and personal goals. Financial literacy lays the foundation for a balanced and successful life.

Empowering Teens for a Lifetime of Success

Teaching teens to focus on building wealth instead of chasing riches or fame isn’t just about money—it’s about giving them the tools to live a life full of freedom, confidence, and meaningful choices. When they grasp the difference between fleeting rewards and creating a solid foundation for their future, they’re empowered to live with clarity and purpose.

When we give teens the tools to manage money, make smart investments, and think long-term, we’re setting them up for financial independence. They’ll be ready to handle life’s challenges, take advantage of opportunities, and build a future that matches their dreams and values.

The most important lesson isn’t just about money—it’s about mindset. Along the way, teens build habits like patience, discipline, and resilience, which will influence how they tackle every part of their lives.

As parents, educators, and mentors, it’s our responsibility—and privilege—to guide teens toward these lessons early. The time and effort we put into teaching them now will pay off in ways that go far beyond money. It’s about giving them the tools to build a future filled with stability, success, and true freedom. Let’s empower the next generation to create a life they can be proud of.

Like what you read? Subscribe to Astute Investor’s Calculus

Subscribe to Astute Investor’s Calculus

Disclaimer: The information provided is for educational purposes and should not be considered financial advice. Past performance is not indicative of future results. Always do your own research or consult with a licensed financial advisor before making investment decisions.

Remember what goes up must come down (eventually)

Stay safe and invest wisely and this is in no mean financial advice. [Full Disclaimer]

A guest post byShailesh Kumar, MBAMBA from the University of Michigan, former management consultant, and entrepreneur with multiple exits. With 25+ years perfecting small-cap value investing, I bring exclusive, high-growth strategies for building wealth.