Apple: So much for cheap iPad

By Bill Maurer from Seeking Alpha

By Bill Maurer from Seeking Alpha

Summary

Company launches new iPad at Chicago tech event.

Price point did not drop from previous model.

Did this do enough to make inroads in the classroom?

At a Tuesday event in Chicago, Apple (AAPL) announced a new version of its iPad in an effort to make inroads in the US education space, where the company has trailed competitors like Microsoft (MSFT) and Alphabet (GOOG) (GOOGL). While the new tablet is certainly better than the older version it replaces, the company may not have done enough to make the progress many were looking for.

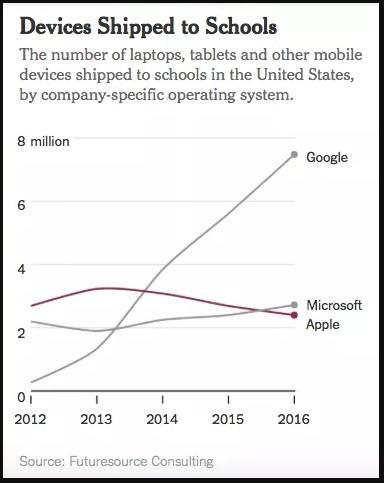

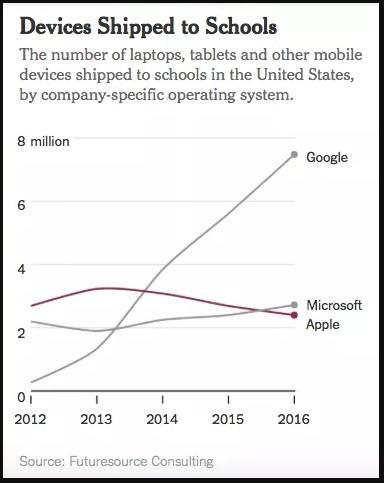

As the chart below shows, Apple has been well behind Google in the US school race, primarily because of device pricing. There were many that were expecting a lower priced iPad could help reverse this trend, with the new tablet perhaps starting as low as $259. Apple’s event comes just a day after Google launched its first Chrome OS tablet, also aimed at the education market.

(Source: Philip Elmer-Dewitt article)

As expected, the new iPad was again a 9.7 inch screen version, and it does contain support for the Apple Pencil. The A10 chip that currently is on the two Pro iPad models also comes over, a nice upgrade from the A9 chip in the previous 9.7 inch model. The company is also giving students 200 GB of iCloud storage for free, a substantial increase from the 5 GB given previously.

However, Apple did not meet expectations when it came to price. The new iPad goes for $329 for consumers and $299 for schools, the same pricing that the old model contained. While the new version obviously has some hardware upgrades and Pencil support, the price point is likely a disappointment for those who thought Apple was moving down the price ladder.

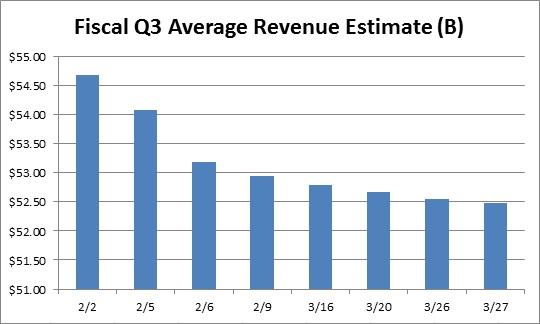

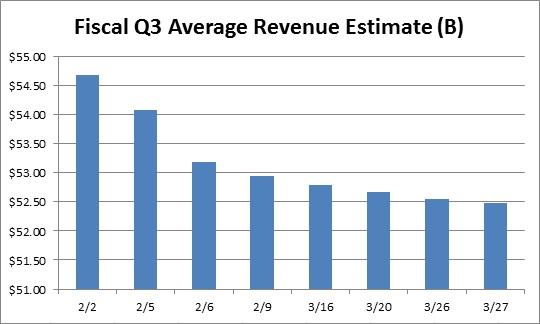

The one financial headwind that Apple faces is that last year’s June quarterwas the first strong one for the iPad in quite a while. A 15% rise in year-over-year iPad sales helped add 2% to the tablet’s revenues, but there also was a Pro iPad launch in June. Will this refresh today be enough to overcome a high bar if Apple does not launch another tablet in the coming months? Uncertainty over refreshes may be one reason why analyst estimates for Apple’s fiscal Q3 have hit a new low today as seen below.

(Source: Yahoo! Finance Apple estimates page)

Now I’m certain there will be some critics that argue if Apple did come at a $259 price point, or perhaps even lower, that I would be complaining about margins. That is definitely not the case. I have been one of the biggest supporters of the iPhone SE, not just because of screen size, but because I am looking for Apple to gain more market share. I have been calling for Apple to update the small screen phone, and in recent years discussed perhaps a cheaper phone to target emerging markets.

At the prices Apple is charging, the market for smartphones and tablets is only so big. I would rather take a percentage point or two hit to overall gross margins to see further revenue growth in these areas, because headlines focus more on the top line number than gross margins. Bears will complain a lot more if Apple reports revenue declines than they will if gross margins tick down a little. Also, getting more users into the Apple ecosystem can help boost revenues of other products as well as the booming services business. On the bottom line, Apple is delivering plenty of profits, and the continued buyback will help improve EPS further even if operating profits decline ever so slightly.

Did Apple do enough on Tuesday to make a substantial move in the education space? The new iPad is certainly an upgrade, but the unchanged price seems to be a disappointment for those thinking Apple would go lower. I got the same feeling when I read the headline yesterday of a potential “$700 budget iPhone” coming later this year. Apple faces a high bar in the coming months thanks to a strong 2017 for iPad sales after last year’s launches. What do you think of Tuesday’s reveal? I look forward to your comments below.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.