Blockchain industry primed for $291 billion revenue by 2030 driven by asset tokenization, says GlobalData

The blockchain industry, although volatile and nascent, has made significant progress in a short span of time, driven by remarkable innovation. Global blockchain platform and services revenue is set to grow from $12 billion in 2023 to $291 billion in 2030. This growth trajectory reflects a more delineated and specialized expenditure pattern, with specific areas such as asset tokenization, blockchain development, and infrastructure services serving as primary drivers of market expansion, says GlobalData, a leading data and analytics company.

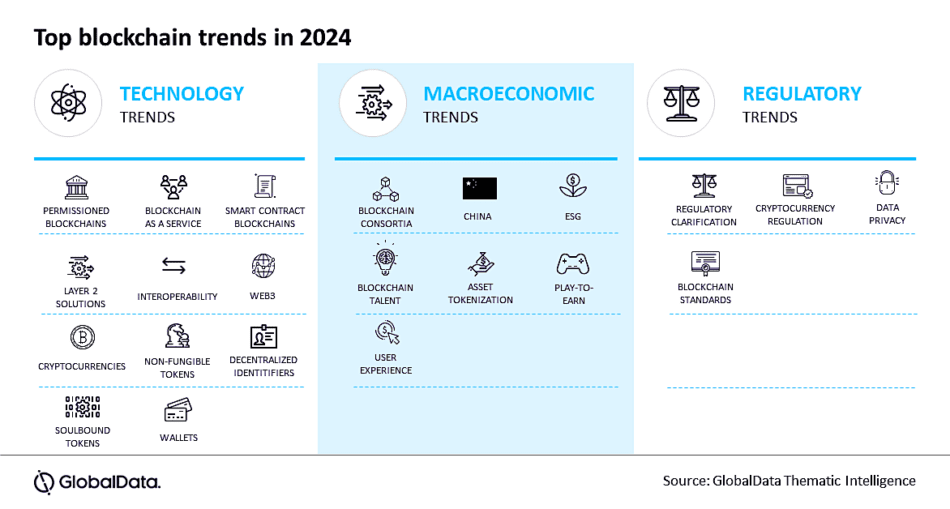

GlobalData’s latest report, “Thematic Research: Blockchain,” reveals a pivotal shift from the technology’s broad, indiscriminate application to more focused, strategic uses. The industry is witnessing a quiet but steady increase in blockchain adoption, concentrating on its practical benefits. This trend is supported by a growing understanding that blockchain’s applicability is not universal and that a robust digital infrastructure is crucial for its successful deployment.

Nicklas Nilsson, Thematic Intelligence Consultant at GlobalData, comments: “When blockchain entered the corporate arena, it was one of the most hyped technologies ever. This initial enthusiasm proved to be a double-edged sword, as early adoption was driven by novelty rather than strategic value, leading to misaligned expectations and objectives and a lack of consideration for its appropriateness in specific use cases or industries.”

Despite the cooling of initial excitement, innovation within the blockchain space persists. The industry is awash with developments like rising competition among smart contract blockchains, the rebranding of blockchain into Web3, the emergence of soulbound tokens, and the ever-vibrant world of cryptocurrencies.

Nilsson adds: “These trends highlight that while enterprise adoption advances steadily, the public blockchain space remains dynamic.”

A standout trend from the report is the emergence of asset tokenization as blockchain’s next major application. Asset tokenization involves using blockchain to convert physical or digital assets into dividable and tradeable digital tokens. These tokenized assets provide a novel approach to owning assets by allowing investors to purchase portions of an asset rather than the entire asset. Asset tokenization can be applied to various assets, including financial instruments such as equities and bonds. However, the benefits are particularly apparent for illiquid physical assets such as real estate, precious metals, and fine art.

Nilsson explains: “If cryptocurrencies were blockchain’s first killer use case, then the tokenization of assets is the second. Virtually every financial giant launched tokenization initiatives in the past two years, citing their significant market potential. These major financial players are not just riding a trend; they recognize asset tokenization as a potential game-changer.”

Converting various assets into tradable digital tokens lowers entry barriers by enabling fractional ownership and enhances global participation through increased liquidity and faster settlements. This has broad implications for how wealth is distributed and how the economy functions.

Nilsson concludes: “Blockchain adoption is unfolding more like a steady journey than a sprint. The early phase of experimentation has given way to more targeted efforts, informed by valuable insights. Even as blockchain remains in its early stages, the innovation it fosters is impressive, with asset tokenization standing out as a prime example. This steady advance in enterprise adoption underlines blockchain’s potential to significantly impact various sectors over time.”

ENDS

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

NOTE:

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.