Card acquiring trends in the Caribbean

By Juan Zafra From Finextra

Card acceptance

In general terms, card acceptance is widespread in tourist areas and continues to experience a period of dynamic growth in the region. Card usage is relatively high in countries with local debit card schemes. CarIFS cards in Barbados and ATH cards in Puerto Rico are highly appreciated by merchants due to their low acceptance cost, while they are widely offered by issuers. Mobile payments are also gaining traction, with solutions such as ATH Móvil in Puerto Rico, or Island Pay in the Bahamas, becoming increasingly popular among consumers.

Nonetheless, in the smaller and more remote towns or islands, cash sometimes remains the only payment option available. This is due to a general preference towards cash among consumers, combined with an overall lack of infrastructure (including the limited presence of banks on some islands and poor connection at terminals). As a response to this, acquirers appear to be targeting small merchants in remote areas with simple and easy-to-use mPOS solutions. These products are tailored to the specific needs of these businesses, commonly on-the-move and with limited card volumes.

Foreign cards

The Caribbean is a major tourist destination for North American and European travellers alike. Correspondingly, inbound transactions make up the majority of credit card spend in the region, with ‘travel & entertainment’-related industries attracting the majority of acquired billings (e.g. hotels, restaurants, airlines).

U.S. travellers account for the majority of inbound spend in the Bahamas, the Cayman Islands and especially Puerto Rico, where c.86% of all tourists came from the U.S. in 2018. Canadians, British (main spenders in Barbados), Russians and visitors from other Caribbean countries make up for the majority of the remaining inbound spend.

Due to the significant influx of U.S. travellers and the fact that local credit cards can be denominated in U.S. dollars in some countries (e.g. the Cayman Islands), acquirers tend to offer settlement in both the local currency and in USD. However, the ease of opening an account in a foreign currency varies across markets. While in the Cayman Islands most merchants have both a KYD as well as a USD merchant account, in the Bahamas and Barbados there seem to be some restrictions in place. In Bahamas, merchants need to have an annual card volume of less than US$100K to open an account in USD, which is in sharp contrast to Barbados, where only a few very large merchants have been granted permission by the central bank to open an account in a foreign currency.

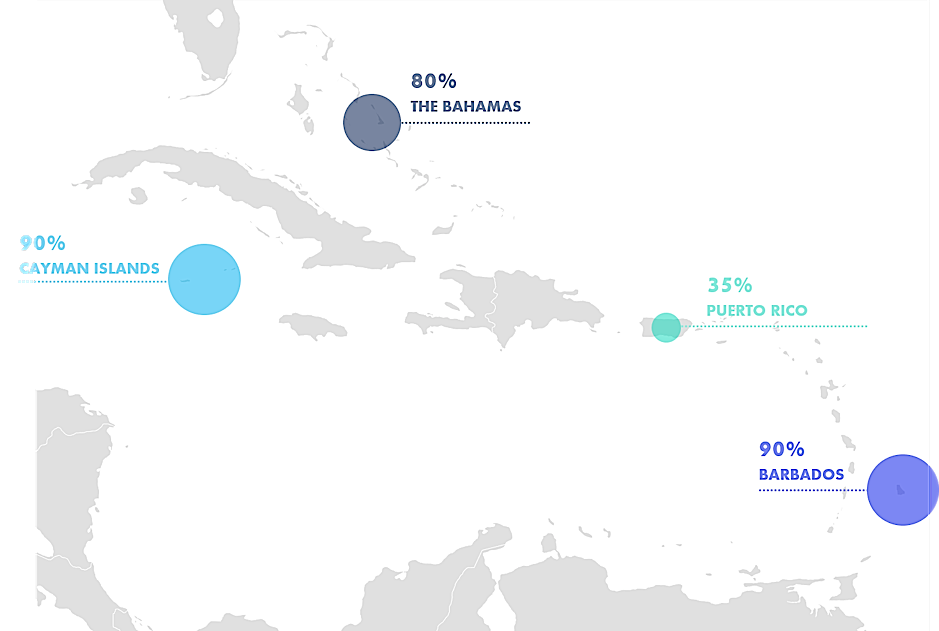

Our estimation of the proportion of foreign card spend out of credit card billings is the following:

Competitive landscape

Three Canadian banks command the acquiring landscape in the Caribbean: Scotiabank, Royal Bank of Canada (RBC) and Canadian Imperial Bank of Commerce (CIBC). There are significant differences across markets though. In Barbados and the Bahamas, these three banks are the leading acquirers, followed by some regional players such as Bank of the Bahamas, Royal Fidelity Bank, and Republic Bank. The aforementioned Canadian acquirers are also active in the Cayman Islands, but two regional banks appear to be the most prominent: Butterfield Bank and Cayman National Bank.

The competitive landscape is very different in Puerto Rico, where the leading acquirer is Evertec, which was created as a subsidiary of Banco Popular and became independent in 2010. Evertec owns the local debit network scheme (ATH) and provides acquiring and processing services to the leading banks: Banco Popular, First Bank and Oriental Bank (with Oriental, the agreement is only focused on processing). Other players are gaining relevance in the island, such as Dynamics Payments and Accepta, which operate on behalf of U.S. based acquirers and process through First Data and Worldpay.

In most countries, competition between providers is extended to the wider banking relationship with the merchant. Acquiring is often used as a tool to onboard businesses and cross-sell other banking products such as payroll, treasury, insurance, lending, credit lines, and cash management services. Therefore, some merchants, particularly large ones, are tied to the acquirer where they have their banking arrangements. This is not the case in Puerto Rico, where cross-selling is not a common practice and there is strong reluctance towards supporting negative margins for card acquiring, even with the largest merchants.

In general, there is little differentiation amongst acquiring banks in terms of technological capabilities. In some areas, acquirers appear to primarily compete on security, stability and reliability – given the limited infrastructure these are the features valued most by merchants. Minimum downtime and quality servicing are key. In addition to this, personal relationships are believed to also play a significant role in choosing providers, especially in small countries.

ISOs and non-traditional players try to differentiate themselves from acquiring banks with innovation and technological capabilities such as smart POS terminals (e.g. Clover, Point) and all-in-one terminal systems, more sophisticated payment gateways and other value-added services.

E-commerce

Most acquirers in the region have the capabilities to facilitate e-commerce, which is believed to have great potential. However, there are significant barriers, and typically, e-commerce is mainly gaining traction with large, well-resourced and longstanding online businesses, which are already successful in other countries. In addition to this, most acquirers still view e-commerce as a highly risky environment; therefore, online acceptance is relatively expensive for merchants.

Fraud remains a major concern; cardholders are often wary of using their cards online or even block the card for online payments. On the other hand, it appears to be popular for local cardholders to use their credit cards with foreign, primarily US-based online merchants.

Industries seeing the highest growth in e-commerce include:

Pricing considerations

In the Bahamas, Barbados and the Cayman Islands, most acquirers still charge one single blended rate for all Visa and Mastercard transactions, including all credit, debit, inbound and commercial card transactions. Tiered pricing and interchange+ appear to only be reserved to a few very large merchants.

In Puerto Rico, tiered pricing has become the standard pricing structure, which is widely offered to merchants of all sizes and verticals. That way, acquirers can now differentiate the cost between qualified and non-qualified card transactions. Interchange+ adoption is slow and mainly limited to the large segment (e.g. QSRs, retailers and international travel merchants).

In the region, the main factors influencing the MDR appear to be the size of the merchant, the risk associated to the industry, the average transaction value, the overall transaction mix (debit-credit, local-inbound, commercial-consumer, CP-CNP) as well as the holistic relationship with bank and the opportunities to cross-sell. MDRs generally tend to be between 2.00% and 4.00%.

Conclusion

Overall, we expect to see further consolidation between key acquirers in the region. Pricing is likely to increase slightly, especially due to the growing volume of non-qualified card transactions (e.g. inter-regional, commercial, card-not-present), as the cost for the acquirer is progressively increasing (higher interchange and scheme fees). As a result of this, acquirers may decide to implement new pricing models (e.g. tiered pricing or interchange +), to pass-through to merchants costs more effectively and protect their margins.

For more on this story go to: https://www.finextra.com/blogposting/18449/card-acquiring-trends-in-the-caribbean