Cayman: KPMG launches Sustainable Investment Framework Navigator (SIFN) tool to measure environmental, social and governance impacts

Cayman Islands (December 8, 2020) – KPMG has collaborated with the University of Cambridge Institute for Sustainability Leadership (CISL) in the development of the Sustainable Investment Framework Navigator (SIFN) tool that provides asset managers with a greater degree of transparency on the environmental and social impacts of their investments.

The project is reflective of KPMG’s environmental, social and corporate governance (ESG) commitments both locally in Grand Cayman, and on a global level.

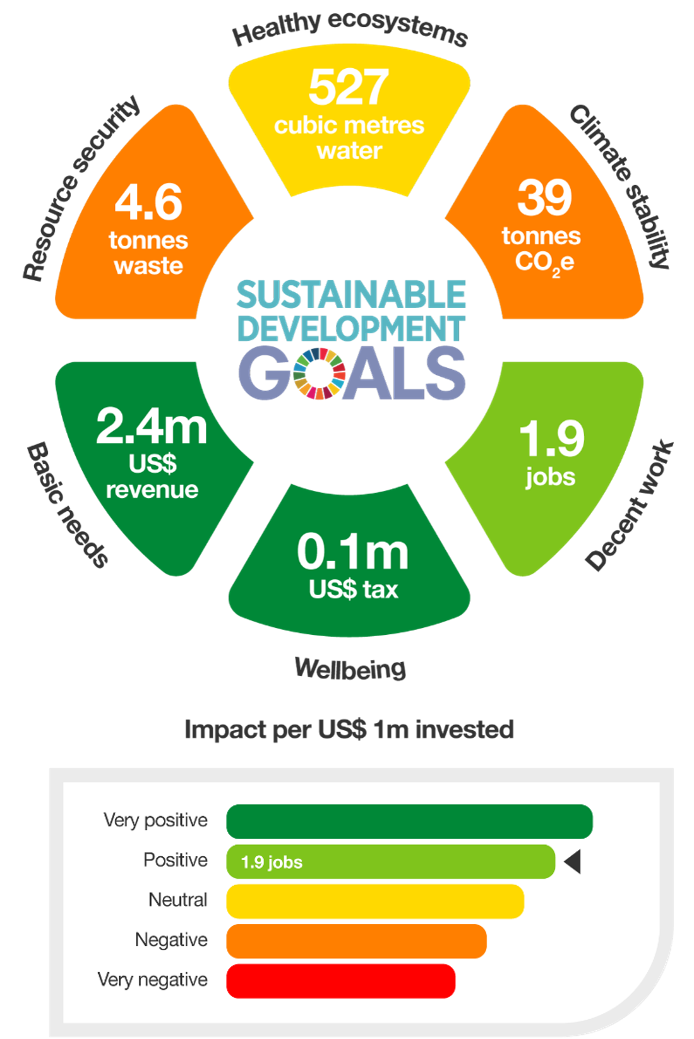

The SIFN is based on the Sustainable Investment Framework, developed by CISL in conjunction with the Investment Leaders Group (ILG). It is designed to measure the real-world impact of an investment fund’s portfolio against a set of six impact themes which asset managers can use as proxies for the performance of their investments and their alignment with the United Nations Sustainable Development Goals (SDGs). These six themes include: Climate stability, Resource security, Healthy ecosystems, Basic needs, Wellbeing and Decent work.

KPMG professionals have invested substantially in technology and innovation in order to help clients overcome their biggest challenges and SIFN aims to do just that. “The SIFN provides the ability to take complex information to gain meaningful insights with a simple dashboard to check their alignment with the SDGs. It is part of our KPMG vision to help our clients build a better world that focuses on sustainability, resilience and impact,” said Anthony Cowell, Head of Asset Management, and Partner at KPMG in the Cayman Islands.

Dr Jake Reynolds, Executive Director, Sustainable Economy, CISL said; “Measuring the impact on one company on one specific theme is reasonably simple provided the requisite data are disclosed. However, poor data coverage, lack of familiarity with the underlying issues and an absence of standardization render neat numbers and comparisons difficult. CISL’s framework offers a solution to this problem in the form of six simple quantitative tests based on readily available data. Our collaboration with KPMG will help us to continue to advance the framework as new data sources become available, including in the vital area of social impact.”

Jodie McTaggart, Senior Manager, KPMG IMPACT at KPMG in the Cayman Islands said; “We are really excited to be part of a global solution. Working alongside the experts from CISL towards a unified way of measuring our impact is a big step towards the future of sustainable and environmentally conscious investment.”

The ultimate goal is to assess all portfolios on a common basis to bring clarity for investment clients and beneficiaries. In doing so, it will help to encourage the movement of capital towards more environmentally and socially sustainable investments and supports asset managers to disclose relevant data in a consistent way.

The SIFN is available now. To learn more, click here.