Domestic Economic Growth in 2015 highest in Cayman Islands since 2007

The Cayman Islands’ System of National Accounts Report 2015 which presents the economic performance of the various industries contributing to the country’s Gross Domestic Product (GDP) has just been released.

The Cayman Islands’ System of National Accounts Report 2015 which presents the economic performance of the various industries contributing to the country’s Gross Domestic Product (GDP) has just been released.

The GDP estimate for 2015 based on data collected from local businesses shows that the local economy expanded by 2.8%, the highest recorded rate of growth since 2007.

“The 2.8% growth exceeded the 2.0% advance estimate for the year based on early indicators,” noted the Minister for Finance & Economic Development, Honourable Marco Archer. “Moreover, it was broad based as all sectors in the economy turned in positive growth rates. This augurs well for the increased diversification of our economic base,” he further stated.

The industries with the highest expansion rates were mining & quarrying led the way; human health & social work (6.9%); construction (6.1%); education services (3.9%); professional, scientific & technical activities which mainly includes legal and accounting services (3.7%); and administrative & support services activities comprising mainly of security and car rental services (3.4%).

The financial & insurance services industry posted a 2.1 percent growth in 2015, which is also the strongest since 2007. The performance was fuelled by increased output in insurance services (4.0%); auxiliary financial services (2.9%); and services of banking institutions (1.6%).

Despite the growth in 2015, the country’s GDP per capita in current prices declined by 0.4 percent to CI$48,167 as the 2.8 percent growth in GDP was outstripped by the 3.6 percent increase in the estimated mid-year population.

For more information on the “The Cayman Islands’ System of National Accounts Report 2014,” please visit www.eso.ky.

From Cayman Islands Semi-Annual Economic Report – Not Complete

Overview*

*Comparative data over the first six months of 2015, except when otherwise indicated. Percentage calculations may not be exact due to rounding-off.

The country’s gross domestic product (GDP) was estimated to have expanded at an annualised rate of 3.0% in the first half of 2016.

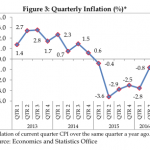

The Consumer Price Index inflation averaged -1.8%, mainly due to price declines in housing and utilities, restaurants and hotels, transport and household equipment.

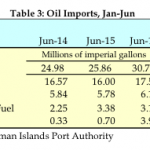

The value of merchandise imports grew by 9.5% to register at $392.6 million, due to strong growth in non-petroleum related products.

Overall unemployment rate stood at 3.9%, slightly lower than in April 2015.

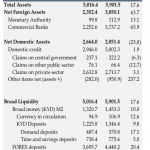

Broad liquidity or money supply expanded by 17.6% to reach $5.9 billion as foreign currency deposits, KYD deposits, and currency in circulation

increased.

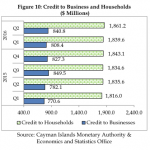

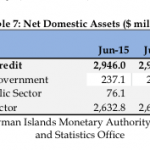

Domestic credit was higher by 1.3% as credit to the private sector increased

while public sector borrowings continued to decline.

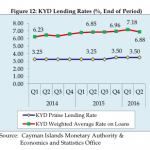

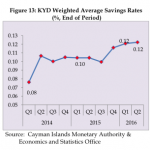

The KYD weighted average lending rate rose from 6.85% to 6.88% while

prime lending rate rose to 3.50% from 3.25% a year ago.

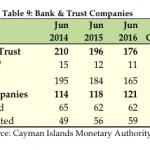

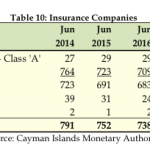

Bank and trust company licenses declined by 10.2%, and insurance licences

by 1.9%.

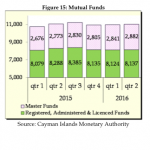

Total mutual funds registration fell by 0.4% to 11,019, notwithstanding an

increase in the ‘master funds’ category by 3.9%.

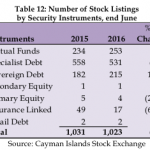

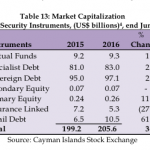

Stock exchange listings declined by 0.8% as most of the types of

instruments fell, except mutual funds.

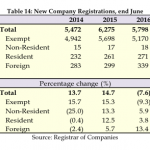

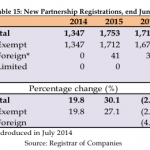

New company and partnership registrations fell by 7.6% and 2.5%,

respectively.

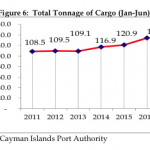

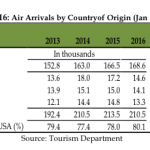

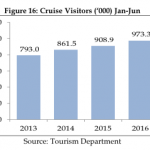

Stay-over visitors declined by 1.4%, but cruise visitors continued to expand;

this time by 7.1%.

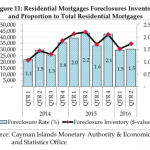

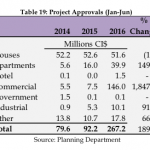

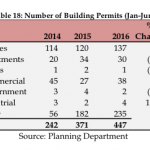

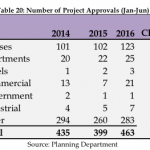

The value of building permits recovered sharply from $81.1 million to

$129.5 million.

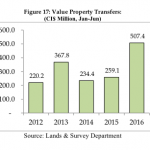

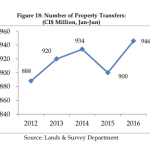

The total value of property transfers spiked by 95.8% to $507.4 million,

supported by an increase in the number of property transferred.

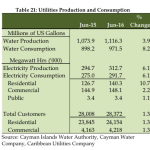

Electricity consumption grew by 6.1% and water consumption by 8.2%.

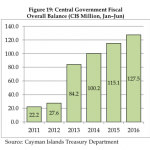

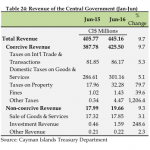

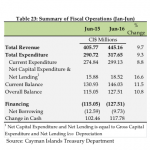

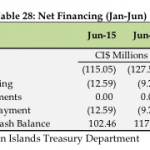

The central government’s overall fiscal surplus improved to $127.5 million

from $115.1 million a year ago.

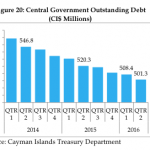

The total outstanding debt of the central government contracted to $501.3

million from $520.3 million a year ago.