IMF G20 Coronavirus

“IMF chief predicts global downturn at least as bad as 2008 crisis, but recovery in 2021.”

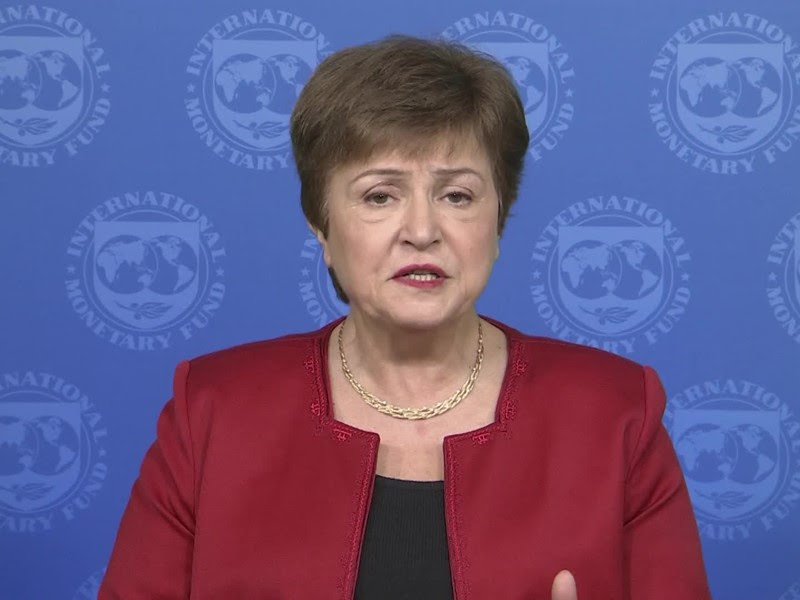

The International Monetary Fund emphasizes the need for a global response and solidarity among all countries to fight the Coronavirus pandemic. Managing Director Kristalina Georgieva made the following statement on Monday following a conference call of G20 Finance Ministers and Central Bank Governors:

“The human costs of the coronavirus pandemic are already immeasurable and all countries need to work together to protect people and limit the economic damage. This is a moment for solidarity, which was a major theme of the meeting today of the G20 finance ministers and central bank governors. There I emphasized three points.

“First, the outlook for global growth. For 2020 it is negative, a recession at least as bad as during the global financial crisis or worse. But we expect recovery in 2021. To get to it, it is paramount to prioritize containment and strengthen health systems everywhere. The economic impact is and will be severe. But the faster the virus stops, the quicker and stronger the recovery will be. We strongly support the extraordinary fiscal actions many countries have already taken to boost health systems and protect affected workers and firms. And we welcome the moves of major central banks to ease monetary policy. These are both efforts that are not only in the interests of each country but of the global economy as a whole. And even more will be needed, especially on the fiscal front.”

“My second point is that advanced economies are generally in a better position to respond to the crisis. But many emerging markets in low-income countries face significant challenges. They are badly affected by outward capital flows and domestic activity will be severely impacted as countries respond to the epidemic. Investors have already pulled 83 billion dollars from emerging markets since the beginning of the crisis. The largest capital outflow ever recorded. And we are particularly concerned about low-income countries in that distress. An issue on which we are working closely with the World Bank.

“Third, what can we, the IMF, do to support our members?

- We are concentrating bilateral and multilateral surveillance on this crisis and policy actions to temper its impact.

- We will massively step up emergency finance. Nearly 80 countries are requesting our help and we are working closely with the other international financial institutions to provide a strong, coordinated response for the largest possible impact.

- We are replenishing the Catastrophe Containment and Relief Trust to help the poorest countries. We welcome those who have already made pledges and call on others to join.

- And we stand ready to deploy all our 1 trillion dollars lending capacity. But we are not stopping there. We are looking at other available options. Several low and middle-income countries have asked the IMF to make a SDR allocation, as we did during the global financial crisis, and we are exploring this option with our membership.

- Major central banks have initiated bilateral swap lines with emerging market countries. As a global liquidity crunch takes hold we need members to provide additional swap lines. And again, we will be exploring with our executive board and membership a possible proposal that would help facilitate a broader network of swap lines, including through an IMF swap facility.”

“Let me finish with the following: These are extraordinary circumstances. Many countries are already taking unprecedented measures. We at the IMF, working with all our member countries, will do the same. Let us stand together through this emergency to support all people across the world. Together we can get through it.”

You can see more about the IMF’s response to the Coronavirus pandemic at: https://www.imf.org/en/Topics/imf-and-covid19