IMF G20/Sri Lanka/ China

The IMF said in a press briefing on Thursday July 14, that third of emerging markets and developing economies are in debt distress and decisive action is needed now.

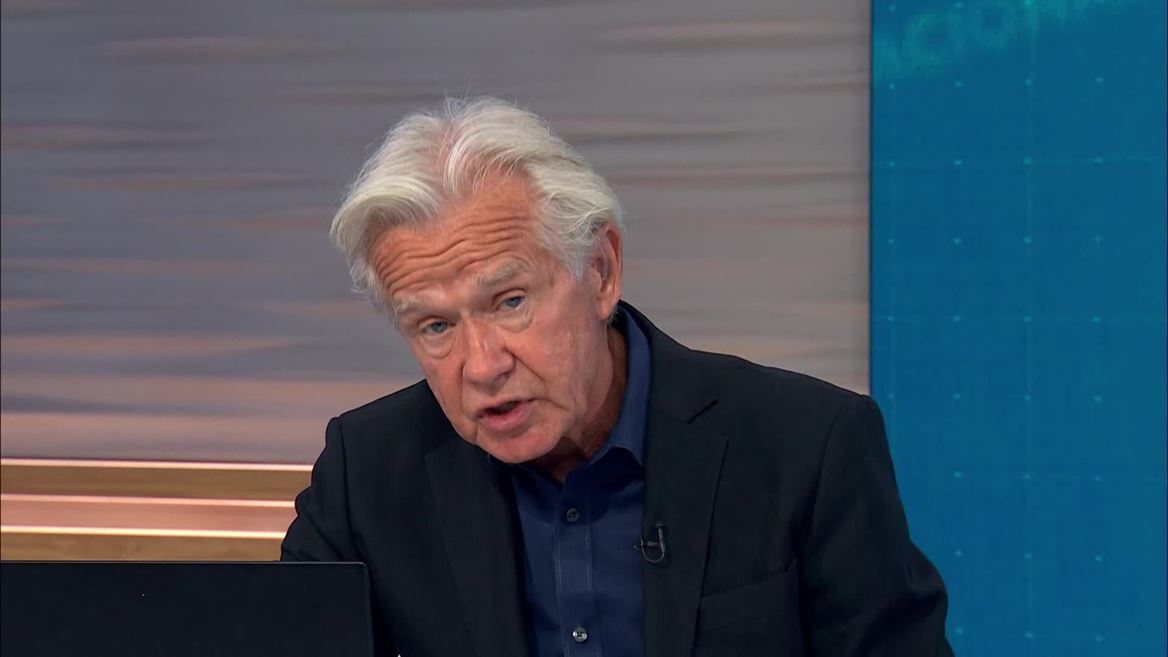

“We’ve been saying that a third of emerging markets and developing economies are in debt distress. And for low-income countries, it’s worse than that. It’s actually nearly twice as high. It is 60%. So, the risk of debt crisis is increasing again as the Managing Director has been warning and urgency is the word. No time for complacency. And she will certainly be bringing that message to the G20 as it meets over these next couple of days,” said Gerry Rice, Director of the Communications Department at the IMF.

Rice expressed the IMF’s concern over the impact of the ongoing crisis on the people of Sri Lanka, particularly the poor and vulnerable groups and guaranteed the IMF’s commitment to support Sri Lanka at this difficult time in line with the IMF’s policies.

“Again, like everyone else, we’re closely monitoring the political and social developments there. We hope for a resolution of the current situation that would allow for our resumption of a dialog on an IMF supported program. You may recall that less than a month ago there was an IMF staff team in Colombo, and we did have discussions, actually constructive discussions with the authorities on a set of economic policies and reforms that could be supported by potentially by an IMF program,” said Rice.

Rice added that economic activity in China is expected to rebound in the second half of the year due to the easing of the strict containment measures in Shanghai and elsewhere that led to widespread disruptions in the second quarter.

“So, clearly a key issue in the short term, given the large impact the recent lockdowns had on economic activity in China, is for macroeconomic policy to step up and meet the challenge of this slowing growth momentum that we are seeing in China. And in that context, we welcome the shift to a more expansionary fiscal policy this year, but even more support would help counter the ongoing growth slowdown. This fiscal support would be particularly effective, in our view, if focused on vulnerable households through transfers and strengthening of the social protection system. In addition, given low core inflation and a still negative output gap, our view is that the People’s Bank of China should continue to provide monetary support. The reduction in key policy rates earlier this year helps lower borrowing costs, strengthens investment. It’s a welcome step towards interest rate based accommodative policy,” said Rice.

To watch the full briefing, click here.