Meet Asia’s biggest hedge fund. (it also makes iPhones.)

Having Apple as a client didn’t help much last year.

In operation for more than 40 years, this outfit has grown to $106 billion in assets with investments in more than a dozen countries. Most of that is in China.

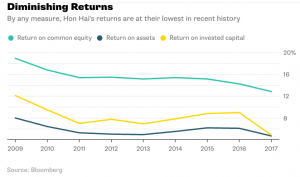

Its returns probably wouldn’t have you popping champagne — 12.8 percent last year on a return-on-equity basis, 4.6 percent if you’re looking at return on assets. But it has never posted a loss, so that’s something. Its founder and chief executive officer is a 67-year-old billionaire while its CFO is a low-key long-termer affectionately known as Money Mama.

Diminishing Returns [See attached]

By any measure, Hon Hai’s returns are at their lowest in recent history

Source: Bloomberg

Oh, and it also makes iPhones for Apple Inc., PlayStations for Sony Corp. and routers for Cisco Systems Inc.

Hon Hai Precision Industry Co. isn’t technically a hedge fund. But, you know, if it looks like a duck and quacks like a duck. And it does a lot of quacking: At the end of 2016 the flagship of Terry Gou’s Foxconn Technology Group held more than $20 billion of hedging instruments in the form of swaps and forwards contracts.

And lest you think hedge funds are only about shorting stocks or trading commodities, it’s worth noting that Westport, Connecticut-based Bridgewater Associates, the world’s largest at around $160 billion in assets, has dabbled in such humdrum investments as equity ETFs.

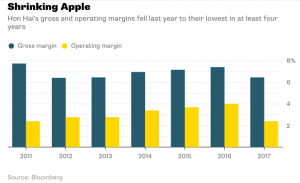

Taipei-based Hon Hai gets about half its revenue from Apple. Yet it also makes a lot of money from activities that don’t involve thousands of people working on a factory floor. In fact, profits on manufacturing are pretty thin and getting thinner. The markup last year — measured as gross margin — fell to 6.44 percent.

Shrinking Apple [See attached]

Hon Hai’s gross and operating margins fell last year to their lowest in at least four years

Source: Bloomberg

And even that profit isn’t just from product assembly. A large portion of the $138 billion of cost of goods sold that it posted for 2017 was actually purchased by or on behalf of clients.

Foxconn gets to channel its customers’ component procurement through its own books — helping it prop up the top line while taking a cut as it flows through to the bottom line. That’s not money from making iPhones but from playing the margins.

Consider operating costs, and the margin drops to 2.4 percent. So the company made just $3.5 billion last year from operations, with the amount coming purely from product assembly being substantially lower. By comparison, its non-operating profit was $2.2 billion.

To understand the financial engineering that goes on at Hon Hai, it’s helpful to examine the dozens of filings the listed entity posted to the Taiwan Stock Exchange last year; they show it’s extremely busy investing in financial products. One such statement, in January 2017, says it spun a 500 million yuan ($79 million) short-term investment into a 2.88 percent annualized return. Remember that its operating margin was 2.39 percent.

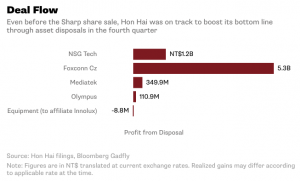

A spate of filings in the fourth quarter put Hon Hai on track to post almost NT$7 billion in disposal gains, equal to 21 percent of its operating profit for the period. Then came the Big Kahuna.

Deal Flow [see attached]

Even before the Sharp share sale, Hon Hai was on track to boost its bottom line through asset disposals in the fourth quarter

Source: Hon Hai filings, Bloomberg Gadfly

Note: Figures are in NT$ translated at current exchange rates. Realized gains may differ according to applicable rate at the time.

By offloading Class C shares in Sharp to its own employees, Hon Hai booked a 252 billion yen profit ($2.4 billion). A Cayman Island company called ES Platform Ltd., supposedly owned by Hon Hai staff members, somehow managed to rustle up $3.3 billion to buy those shares at a very healthy profit to their employer. Hon Hai says the money has gone through but wouldn’t say where the cash came from.

Travis Lundy of Ballingal Investment Advisors Ltd. wrote in Smartkarma this week that one explanation could be that Gou himself is backstopping the deal. I suspect he may be right, which would mean Gou may have also fronted for that giant one-off profit boost at Hon Hai right at the end of what was looking to be a disastrous year for the company.

True to hedge-fund form, not all bets pay off. It’s burning money on the revival of the Nokia brand name, while a stab at the India e-commerce market ended with its majority-controlled subsidiary FIH Mobile Ltd. losing $200 million.

I’ve written before how Gou needs to wean himself off being Tim Cook’s manufacturing partner. He’s no Ray Dalio, but Foxconn’s financials show that Gou does in fact know a few more tricks.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

To contact the author of this story:

Tim Culpan in Taipei at [email protected]

To contact the editor responsible for this story:

Daniel Niemi at [email protected]

IMAGE:

Photographer: Thomas Lee/Bloomberg APPLE INC -0.14

For more on this story go to: https://www.bloomberg.com/gadfly/articles/2018-04-03/harbour-energy-deal-shows-how-china-saved-santos