Roll-out of China’s home-grown passenger jet still up in the air as US tech restrictions expected to persist under Joe Biden

By Cissy Zhou From SCMP

- Concerns are growing over China’s access to key American-made components for the C919 passenger jet, due to a dependency on US exports

- China’s answer to the Boeing-Airbus duopoly on passenger jets still has hurdles to overcome to meet its planned roll-out next year, and not all analysts think it will arrive on time

The administration of US president-elect Joe Biden is likely to continue the Trump administration’s effort to contain China technologically, despite the easing of some concerns about the acquisition of key American components needed for its home-grown C919 passenger jet, according to analyst predictions.

When the United States began tightening controls on technology exports to China, industry insiders and pundits warned of possible delays in the roll-out of the Comac C919 – an integral part of Beijing’s ambitions to break the current Boeing-Airbus duopoly on the manufacturing of large passenger jets.

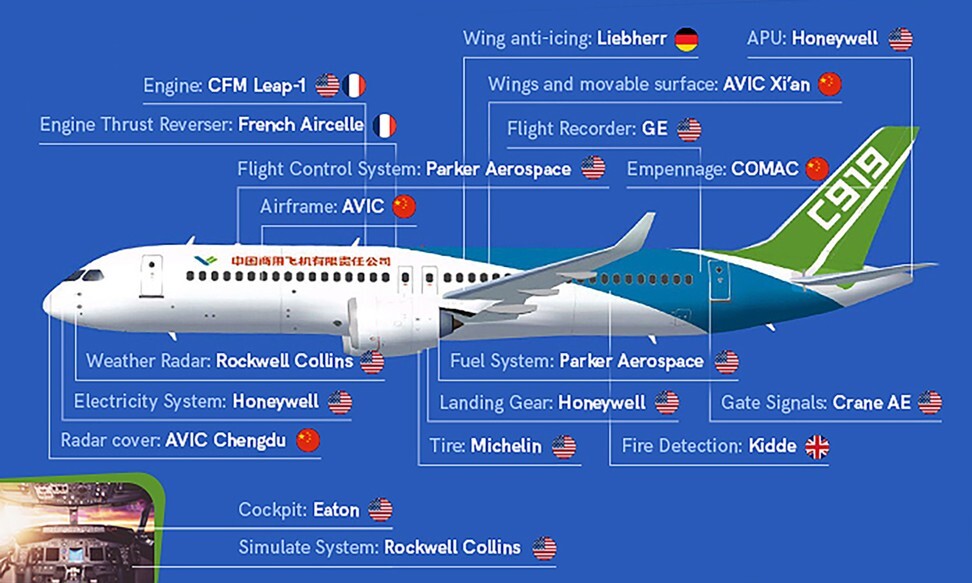

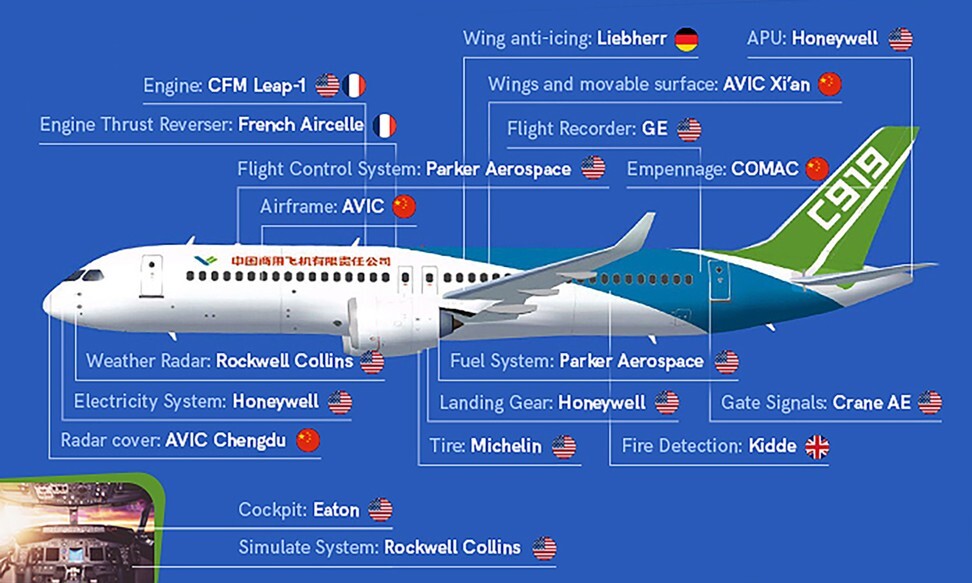

The C919 relies on imports of a number of crucial parts, from its engines to its flight-control systems, so access to US suppliers such as General Electric (GE), Honeywell International and Rockwell Collins is vital for future deliveries of the new model.

A source close to the Commercial Aircraft Corporation of China (Comac), the state-owned company building the plane, told the South China Morning Post on condition of anonymity that the swirling storm between Beijing and Washington has not translated into any real trouble for the C919, at least so far, and that the first delivery of the Chinese airliner is still scheduled for next year.

Furthermore, given a decline in the production of Boeing and Airbus aircraft this year due to the sharp drop in air travel caused by the coronavirus pandemic, some component suppliers “really hope” that Comac can deliver its aircraft on time, the source said.he delivery schedule was confirmed in late October by Wu Guanghui, the chief designer of the C919 programme, who said that Comac was trying to deliver the first plane to China Eastern Airlines before the end of next year. He also said the jet was in the final stage of Type Inspection Authorization (TIA) – a technical examination to check the model’s airworthiness before the Civil Aviation Administration of China (CAAC) can issue three formal certificates that will allow the new aeroplane to enter commercial service.

Comac said last year that it aimed to get all of the necessary certificates for the C919 by the end of 2021 – a delay from the previous target of the end of this year – due to technical issues involving its design, manufacturing, airworthiness compliance and operational suitability.

However, Kevin Michaels, managing director of Michigan-based AeroDynamic Advisory, told the Post this month that he expects the C919 to be delivered later than the 2021 target – possibly in 2022 or even 2023 – due to obstacles involving technical issues and CAAC certification.

He added that it is impossible for China to develop its own jet engines, calling this a chronic “Achilles’ heel” for China. The CFM jet engine used on the C919 is 20 years or more ahead of Chinese technology, and was designed for reliability, he added.Reuters reported in February that the Trump administration was considering blocking GE from selling the LEAP-1C engine to Comac, citing concerns over the possible military applications of the technology. But in the end, the US granted GE a licence to sell the engines to the Chinese company.https://multimedia.scmp.com/widgets/vert_timeline/?id=tradewarannvIn June, the US Department of Defense released a list of Chinese companies – including the Aviation Industry Corporation of China (AVIC), the state-owned military aerospace contractor that is a key supplier for the C919 – and accused them of having ties to the People’s Liberation Army (PRC).The situation was further complicated on Thursday, when US President Donald Trump issued an executive order barring Americans from investing in 31 Chinese companies, including the AVIC, citing national security concerns. In the order, Trump said the PRC exploits American investors to finance the development and modernisation of its military, and that the 31 companies “directly support the PRC’s military, intelligence and security apparatuses and aid in their development and modernisation” by “remaining ostensibly private and civilian”.

Multiple Chinese experts have expressed concerns about whether Trump will continue to make trouble for China before his term ends on January 20.

However, the incoming US administration under Biden is expected to be more pragmatic than its predecessor, raising expectations that US-built components for the C919 will not be blocked. On Friday, China congratulated Biden on his election victory after days of silence.

“The Biden foreign policy team will be composed largely of sensible centrists guided by Biden’s pragmatism. Given the importance [of protecting] American jobs in the aviation industry, I would expect the Biden administration to want to reassure China,” said Andy Mok, a senior research fellow at the Centre for China and Globalisation, a Beijing think tank.

Shi Yinhong, a professor of international relations at Renmin University and an adviser to the State Council, said the United States may be less likely to suddenly cut off the supply of components for the C919, but the Biden administration will still continue trying to contain China, especially in the technology realm. And he said the US will “definitely” create difficulties for the C919 in the so-called freedoms of the air – a set of commercial aviation rights granting a country’s airlines permission to enter and land in another country’s airspace.

Shi said that the freedoms of the air are more essential over the long run compared with other potential obstacles, given that the C919 has been specifically designed to cater to China’s burgeoning domestic travel demand in the near term.

“If the US wants to set obstacles, there are always excuses, as the line between civilian and military use is not always very clear,” Shi added.

The twin-engined single-aisle C919 can seat up to 168 passengers and is intended to compete with similar jets by Boeing and Airbus. Photo: Aerotime

Luya You, a research analyst for the transport and infrastructure sector at Bocom International, said Comac may increasingly prefer European suppliers over American ones in the future, as it will be difficult for Comac to find home-grown replacements. She said this is due to major manufacturers of original equipment sharing similar suppliers, given the complexities of the technology and the high degree of consolidation in the market.

Comac had received 815 orders for the C919 as of the end of May – 781 domestic orders and 34 overseas orders. And last month, China Express Airlines, a Chongqing-based regional airline, said it intended to purchase 100 planes from Comac, among which up to 50 could be the C919.

Chinese airlines will need 8,600 new aeroplanes worth US$1.4 trillion over the next 20 years, Boeing said on Thursday, adjusting its 8,090 estimate from last year.

An earlier report by the Shenzhen-based Century Securities in May estimated that demand for all civilian aircraft in China would total 9,000 planes over the next two decades, and that the C919 was expected to account for about 2,000 of those planes.

lThis article appeared in the South China Morning Post print edition as: Fate of China’s home-grown passenger jet up in the air.