To Counter Fraud

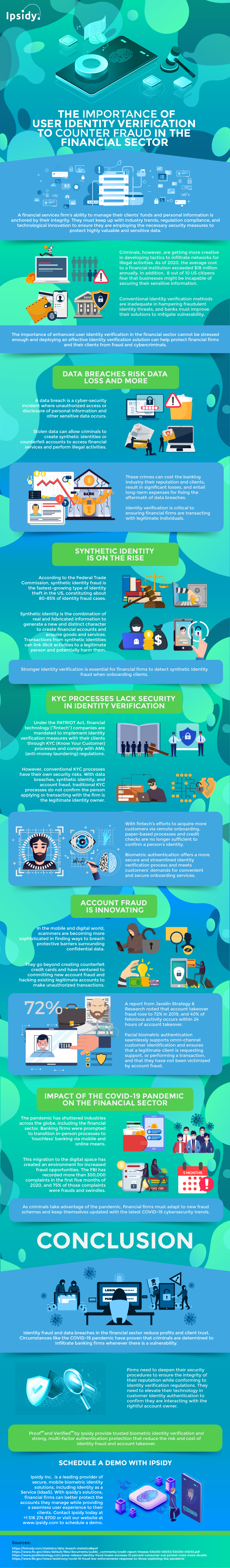

The Importance of Trusted User Identity Verification to Counter Fraud in the Financial Sector

Financial firms are richer targets for money-driven criminal attacks than other institutions in the regulated sector. Fraudsters often try to infiltrate their networks to carry out illegal activities like money laundering and terrorism financing.

Some try to steal valuable data like an individual’s personal information and sell them on the black market. With these security threats, government agencies remain staunch in implementing laws and monitoring compliance with Know Your Customer (KYC), Anti-Money Laundering (AML), and Counter-Terrorism Financing (CTF) regulations.

Banking establishments are mandated to deploy anti-fraud security measures to protect their clients’ valuable data and funds. However, conventional KYC processes like personal security questions and credit checks are not sufficient in identifying fraudulent individuals.

One of the most recommended ways to counter fraud in the financial sector is to utilize multi-factor authentication (MFA) methods in identity verification. MFA deploys two or more layers of security checks to validate a user and the identity documents they provide.

With MFA enabled, the system can analyze and match a user’s selfie and provided identity documents to verify if the individual is the legitimate identity and credential owner. Moreover, this technology also scans if the uploaded document is authentic or falsified.

Some individuals are legitimate and match the photo on the document, but the ID itself might be fake. Original government-issued credentials are often embedded with security markings to distinguish them from fraudulent ones.

By implementing effective MFA technology at customer onboarding, financial companies can block criminals from creating an account for illicit activities. Likewise, employing user ID verification before authorizing transactions ensures that the firms interact with the real account owner.

Deploying a multi-factor authentication service can help financial firms mitigate fraud for security, privacy, and regulatory compliance purposes. Numerous vendors are already available in the market, and enterprises must choose which provider best suits their preferences.

The importance of using a trusted identity proofing solution in the financial industry cannot be stressed enough. To know more about this matter, Ipsidy provides the infographic below.