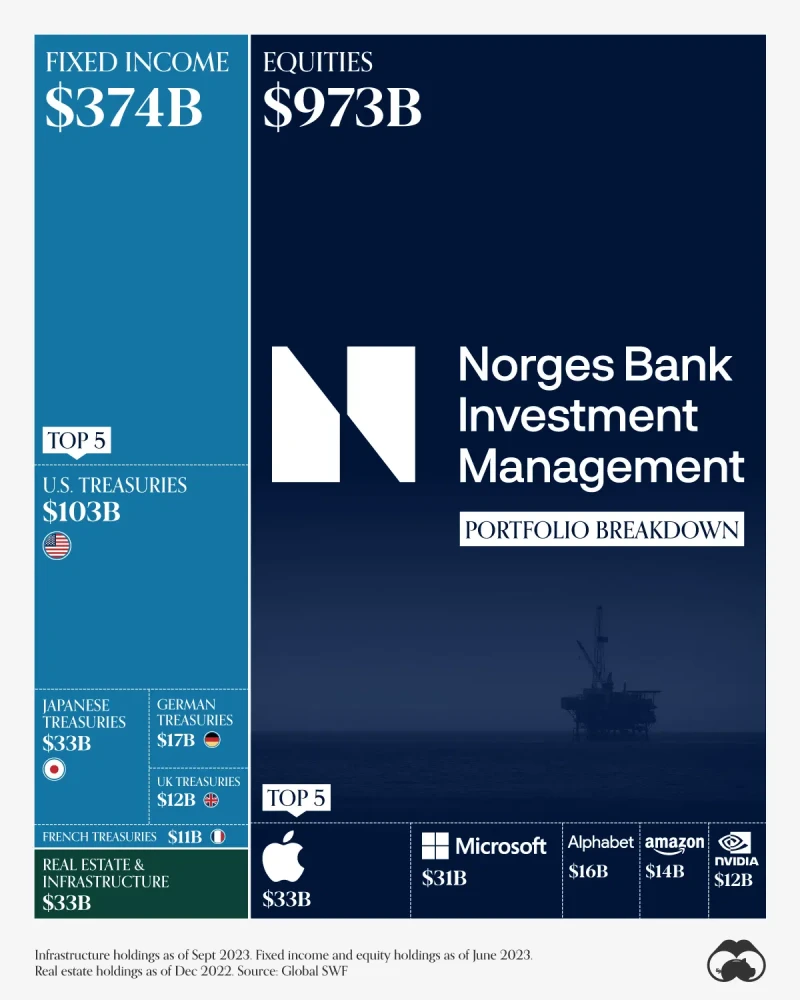

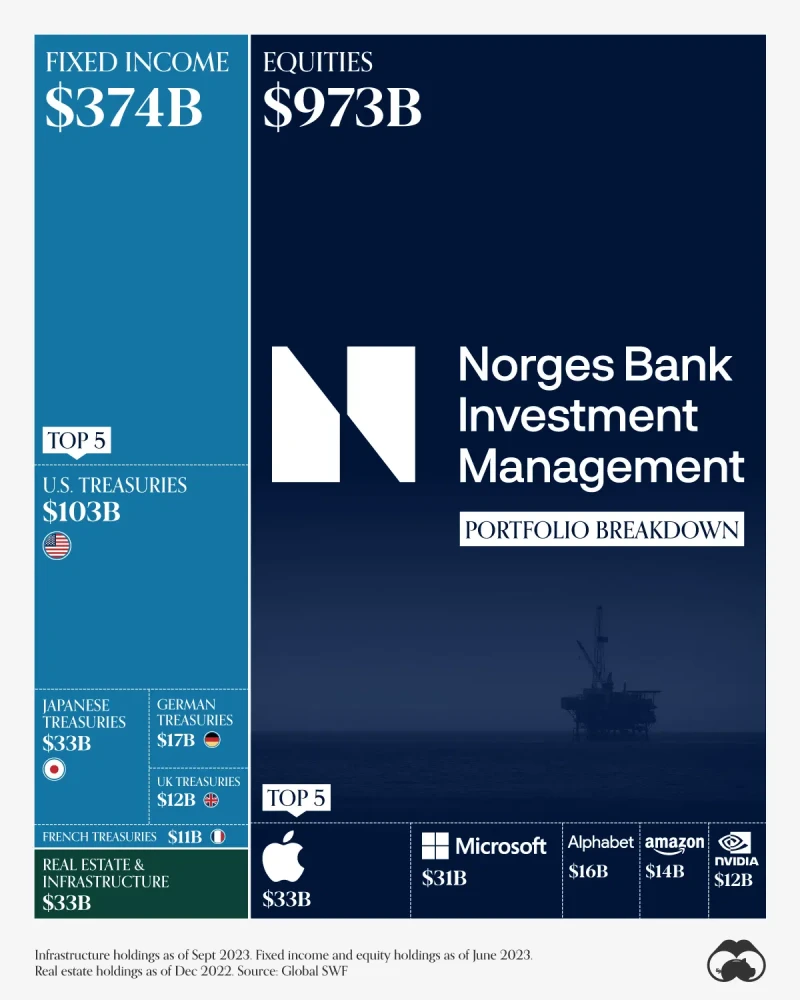

Visual Breakdown of Norway’s $1.4 Trillion Sovereign Wealth Fund

Norway is home to the biggest sovereign wealth fund globally, valued at nearly $1.4 trillion.

In 2023, the fund posted record profits, bolstered by tech holdings that include Microsoft, Apple, and Nvidia. Originating in 1996, the fund was created to invest surplus earnings from its massive energy sector—where it ranks as the fourth-largest exporter of natural gas in the world.

This graphic breaks down the portfolio of Norway’s sovereign wealth fund, based on data from Global SWF.

Portfolio Breakdown of Norway’s Sovereign Wealth Fund

Here’s how the fund, Norges Bank Investment Management, invests its portfolio according to asset type:

| Asset Class | Value | Percentage of Portfolio |

|---|---|---|

| Fixed Income | $374B | 27.1% |

| Equities | $973B | 70.5% |

| Real Estate | $30B | 2.2% |

| Infrastructure | $3B | 0.2% |

Infrastructure holdings as of Sept 2023. Fixed income and equity holdings as of June 2023. Real estate holdings as of Dec 2022.

As we can see, the majority of the fund is invested in equities, with a 70.5% share of the portfolio.

Overall, the fund invests in 9,000 companies worldwide, with the highest exposure across North American firms. As the table below shows, the top five holdings in the portfolio are heavily concentrated in the tech sector:

| Equities | Value |

|---|---|

| Apple | $33B |

| Microsoft | $31B |

| Alphabet | $16B |

| Amazon | $14B |

| Nvidia | $12B |

Apple is the portfolio’s largest equity holding, worth $33 billion. Last year, the tech giant witnessed 45% returns.

The next largest asset type is fixed income, which makes up 27.1% of the portfolio. The greatest share is held in government bonds, but the fund also invests a portion in debt issued from the corporate sector. Here are the top fixed income holdings across the portfolio:

| Fixed Income | Value |

|---|---|

| U.S. Treasuries | $103B |

| Japanese Treasuries | $33B |

| German Treasuries | $17B |

| UK Treasuries | $12B |

| French Treasuries | $11B |

In addition to equities and fixed income, the fund invests in real estate and infrastructure.

This covers 890 investments globally which are found mainly in office and retail sectors. In fact, between 2012 and 2022, these investments have grown over eightfold to $33 billion—which include a 25% ownership in London’s Regent Street, one of the city’s busiest shopping districts with over 7.5 million visitors annually.