ZTO Express (Cayman) Third Quarter 2023 Earnings: EPS beats expectations, revenues lag

Key Financial Results

- Revenue: CN¥9.08b (up 1.5% from 3Q 2022).

- Net income: CN¥2.35b (up 21% from 3Q 2022).

- Profit margin: 26% (up from 22% in 3Q 2022). The increase in margin was primarily driven by lower expenses.

- EPS: CN¥2.91 (up from CN¥2.39 in 3Q 2022).

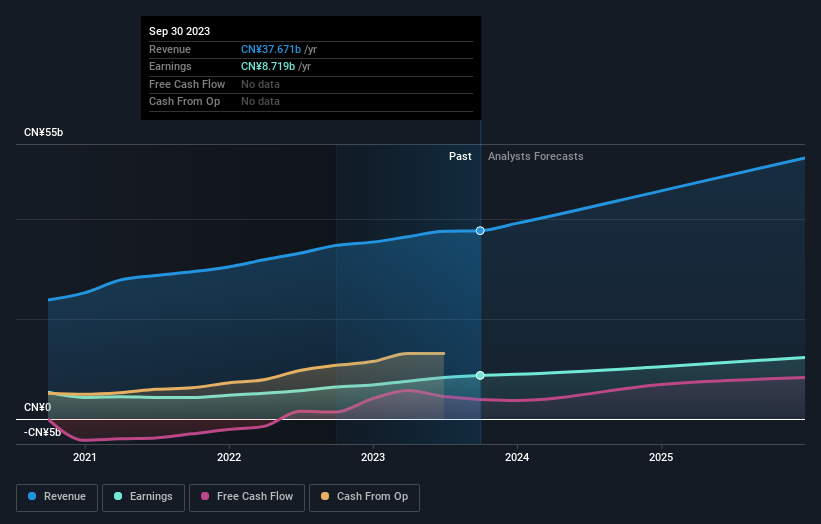

All figures shown in the chart above are for the trailing 12 month (TTM) period

ZTO Express (Cayman) EPS Beats Expectations, Revenues Fall Short

Revenue missed analyst estimates by 7.8%. Earnings per share (EPS) exceeded analyst estimates by 7.6%.

Looking ahead, revenue is forecast to grow 14% p.a. on average during the next 3 years, compared to a 3.6% growth forecast for the Logistics industry in the US.

Performance of the American Logistics industry.

The company’s shares are down 6.5% from a week ago.

Balance Sheet Analysis

While earnings are important, another area to consider is the balance sheet. See our latest analysis on ZTO Express (Cayman)’s balance sheet health.

What are the risks and opportunities for ZTO Express (Cayman)?

ZTO Express (Cayman) Inc. provides express delivery and other value-added logistics services in the People’s Republic of China.Show more

Rewards

- Price-To-Earnings ratio (15x) is below the US market (15.9x)

- Earnings are forecast to grow 14.67% per year

- Earnings grew by 36.1% over the past year

Risks

No risks detected for ZTO from our risks checks.View all Risks and Rewards

Share Price

Market Cap

1Y Return

Further research on

ZTO Express (Cayman)ValuationFinancial HealthInsider TradingManagement Team